With the Food and Drug Administration’s (FDA’s) recent approval of the first interchangeable insulin, Viatris and Biocon’s Semglee®, some questions may begin to be answered with respect to payer coverage, automatic substitution, and their potential for success in the marketplace. However, unlike the other biologic drug categories, there are additional levels of complexity among the insulins that may affect future competition.

At the DIA Biosimilars 2021 conference last week, Stephanie Ho, PharmD, Pharmacist Evidence Analyst & Strategist, Kaiser Permanente, spoke about how biosimilar insulins may impact payers. Her virtual presentation implied some very interesting issues, and this post will explore some of them.

Insulin Is One Category, not One Drug

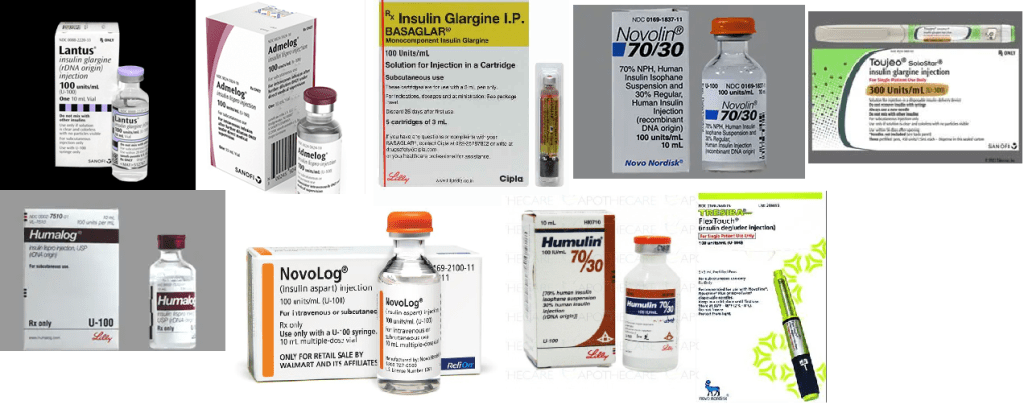

First, we must remember that insulins come in several varieties—all necessary to treat a spectrum of patients. These include long-acting (e.g., insulin glargine, detemir, degludec), rapid-acting (e.g., insulin lispro, aspart, glulisine), short-acting (e.g., regular), intermediate-acting (e.g., NPH), and premixed combinations (e.g., 70/30, 50/50, 75/25 mixes). The currently approved and available follow-on products include Basaglar® and Toujeo® for glargine (Lantus®) and Admelog® for lispro (Humalog®). These were approved through the 505(b)2 pathway prior to the formal insulin transition to biosimilars in March 2020.

The only currently approved insulin biosimilar (and interchangeable) is Semglee, which is also a long-acting glargine product. Originally, this agent was approved as a follow-on, as it raced to beat the transition deadline for submission as a biosimilar. The only authorized generics available for insulin are Lilly’s lispro and Novo Nordisk’s aspart, unbranded fast-acting insulins.

Authorized Generics or Authorized Biologics?

That said, there are no authorized generics in the same category of a biosimilar insulin—yet. Dr. Ho noted that the price of insulin glargine more than doubled between 2010 and 2019. Based on the current regulations, can Sanofi, manufacturer of the reference product Lantus, bring out what would now be called an “authorized biologic”? It’s an intriguing question, but it may be more academic than real; Sanofi already has its follow-on insulin glargine product, Toujeo.

Lilly and Novo Nordisk introduced their authorized generics in 2019 and 2020, respectively, to release the growing pressure placed on them by Congress, which was scrutinizing the large, unjustified increases in insulin prices.

These authorized generics cut the existing rapid-acting insulin prices by around 50%, according to GoodRx. According to data from Amerisource Bergen and presented by Dr. Ho, Walmart was advertising the generic at a price that was 75% below the NovoLog’s list price. As you might imagine, Lilly and Novo Nordisk are not marketing the authorized generics, preferring instead to focus on their higher-priced brands. Still, it raises the question as to whether there could be a market for biosimilar rapid-acting insulins. If they would compete against the authorized generics and not the brands, the biosimilar opportunity could be very limited indeed.

Interchangeability and the Authorized Generic

From a practical perspective, there is no difference between the authorized generic for insulin lispro and Humalog, for example. Lilly simply sells it without the brand name but with the same pen-delivery system. Barring manufacturing drift, it is the same formula, made in the same way, with the same clinical effect. If that isn’t an interchangeable biologic, what is?

Somewhat surprisingly, the health plans and insurers haven’t automatically substituted en mass Humalog and Novolog for lispro and aspart. Perhaps there is portfolio contracting at play here, which may prevent such a move. That may seem reasonable, as both Lilly and Novo Nordisk offer several types of insulin.

Consider also that some plans have switched Basaglar for Lantus in the glargine category, without apparent clinical consequences for switch. By that same consideration, plans were not required to cover both Humalog and Novolog rapid-acting insulins; when changing health plans, patients would take whichever was covered by their new insurer or pharmacy benefit manager.

The unique complexities of the insulin market will certainly affect the potential market dynamics for prospective biosimilar makers. Novo Nordisk can limit the success of a new biosimilar insulin detemir by either introducing its own authorized biologic or by simply cutting the price of its originator brand. It could be a real consideration of a manufacturer developing additional biosimilars for different insulin types.